What is Lifetime Value?

Oct 22, 2024

The business world is always abuzz with the latest trends and innovations, but there’s one metric that has always been a staple: customer lifetime value.

CLV is the total worth to a business of a customer over the duration of their relationship. Because it’s less expensive to keep existing customers than acquiring new ones, improving CLV is a worthwhile endeavor.

From a numbers perspective, lifetime value is the total financial contribution made by a customer over their lifetime with your business. It’s a useful indicator to find ideal customers, predict future profitability of your store, and to understand customer behavior.

Lifetime Value is also known as Customer Lifetime Value, and it is represented by acronyms such as CLV, LTV, or CLTV.

Among the many metrics available in the ecommerce world to analyze store operations and profitability, Customer Lifetime Value is considered one of the most important for your online store.

Why Should Lifetime Value be Your Store’s Primary Metric?

Amidst the daily hustle, most ecommerce merchants, both big and small, forget that CLV can be their “go-to” metric for crucial decisions.

In fact, successful ecommerce business owners use CLV to analyze ongoing marketing operations, while also finding ways to improve their products and customer service.

Instead of placing emphasis on top of the sales funnel (customer acquisition), CLV helps you understand how many acquired customers are retained, and which of them continue to give you business after their first purchase.

In other words, with CLV as your primary metric, you can recognize profitable customers and focus resources on acquiring and retaining them. Otherwise, you may spend those finite resources on less profitable, one-time customers.

By calculating CLV for all your customers, you can easily rank them based on their impact to the bottom line. You can then use this financial insight to formulate and implement customer-specific strategies for maximizing profits over the long haul.

So, to summarize:

Calculating CLV helps ecommerce stores know how much they can invest when acquiring and retaining customers, to result in a profitable ROI.

Accurately calculated CLV empowers merchants with a customer-centric approach, allocating their limited resources to achieve a maximum return.

CLV can predict the future profitability of customers, thereby highlighting marketing dollars needed to retain those customers.

How is Customer Lifetime Value Different From Traditionally Used Customer Retention Metrics?

Strangely enough, despite its numerous benefits, calculating customer lifetime value has only become a norm recently across the ecommerce space.

Traditionally, merchants have used outmoded systems to analyze customer loyalty and retention. While these methods definitely have their advantages, they do differ from CLV.

There’s also a possibility you might be using one of these older methods. So, let’s look at some of these classical retention techniques, and play out how they’re not the same as a CLV calculation.

RFM Approach

Past Customer Value (PCV)

Share of Wallet (SOW)

RFM Approach

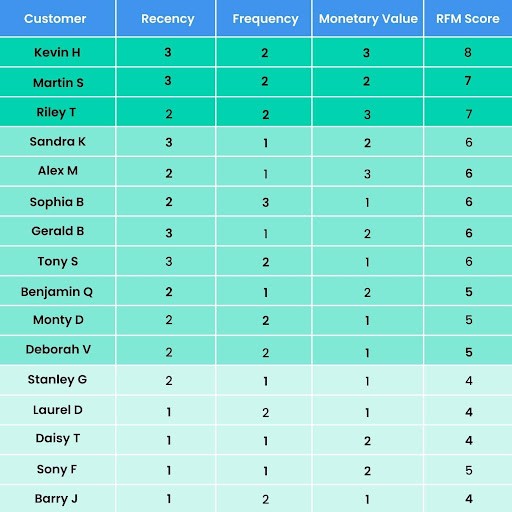

RFM approach is historically one of the best methods to check customer retention and loyalty. The acronym stands for Recency (R), Frequency (F), and Monetary Value (M).

Recency refers to how recently a customer placed an order with your store. Frequency is how often a customer orders from your store over a given time period. Monetary Value represents the average amount a customer spends on transactions.

For this approach, a store ranks its customers based on these 3 attributes. Each attribute is given a score; those with high attribute scores appeared on top of the list, and were considered most profitable and receptive to future product offers.

Customers scoring low for these attributes were at the bottom of the list, and were considered to be the least receptive to future offers.

By segmenting your customer base using the RFM technique, you can maximize returns on marketing investments by targeting receptive and high value customers.

How is RFM different from CLV?

A major drawback with most traditional metrics is that they are not forward-looking; they don’t fully weigh how a customer may be active in the future.

The RFM approach assumes that three attributes predict the future value of a customer: recency, frequency, and monetary value.

However, what RFM fails to examine are critical factors like churn rate, average order value, rate of retention, and customer acquisition cost (to name a few). These variables help predict the future purchasing behavior of a customer.

To summarize, although RFM is beneficial for segmenting customers, it shouldn’t be used as a definitive metric to measure a customer’s financial worth to your business.

Past Customer Value (PCV)

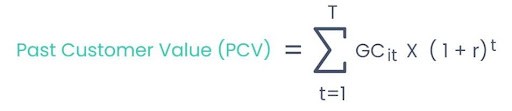

Past Customer Value (PCV) assumes that future customer profitability or value is based on past purchasing behavior. By calculating the value of a customer’s previous purchases, the merchant can then estimate their future value.

PCV is calculated by using the below formula:

Here,

i represents the customer;

r represents the discount rate;

T represents the past time periods when customer made purchases;

GCit represents the gross contribution of the customer in the given time period

Σ represents the sum of total gross contributions up to "T" past time periods

How is PCV different from CLV?

By definition, PCV has two major limitations:

It doesn’t consider the costs expected to maintain a customer relationship in the future.

It can’t determine if a customer will be active in the future.

So once again, this traditional metric has little to say whether a customer will continue doing business with you.

In contrast, CLV provides calculated insight as to when a customer may buy, how much he or she may spend, and how much it costs to capture the sale. Rather than extrapolating PCV, CLV analyzes existing purchases of a customer in a given time period, considers multiple aspects required to retain a customer, and then provides an informed decision.

Using this data, merchants can then compete better with other players in the market and also work on improving their customer relations.

Share of Wallet (SOW)

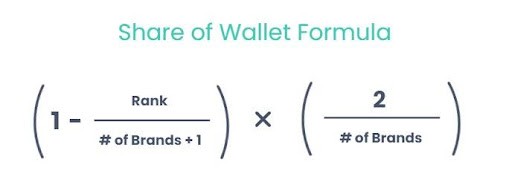

Share-of-wallet (SOW) is primarily used to find a customer’s purchasing preference. It identifies money spent by a customer on a specific brand, compared to other competing brands, thereby revealing their preference.

Though it is predominantly used to measure consumer behavior, SOW can be used as an indicator of customer loyalty to any of your store’s brands.

SOW is calculated by using the wallet allocation formula:

Here,

Rank represents the consumer rank of a certain brand.

Brands represent the total number of brands you are measuring against.

How is SOW different from CLV?

SOW is calculated based on customer responses. It cannot give us a clear indication about future revenue and profit that can be expected from a customer. Although SOW can benefit marketing strategies, it shouldn’t be used to gauge a customer’s worth.

Above are just a few reasons why CLV is a better assessment of customer loyalty, rather than using traditional metrics.

Now that we understand why CLV is a more effective measurement of customer loyalty, it’s important that we unlock how CLV is calculated. We’ve also shared these calculations in our Guide to Customer Lifetime Value.

3 Mistakes To Avoid When Calculating Customer Lifetime Value

Here are the 3 mistakes that you should avoid when determining CLV:

Mistake 1 - Not distinguishing subscription and non-subscription ecommerce customers

Let’s start this on a sobering note.

It’s more challenging to analyze customer lifetime value for non-subscription businesses because “rate of retention” cannot be easily applied here. In fact, CLV is a highly accessible solution for subscription-based sales models, where retention rate can be easily calculated.

For example, if you have an ecommerce business where customers pay a subscription fee to receive fresh groceries each month, then it’s easier to determine customer retention and loyalty via CLV.

However, if you sell products that are bought periodically throughout the year, then expect CLV calculation to be a somewhat more complex formula.

That said, before tracking down various types of CLV formulas and tools, ask first whether your ecommerce business is a subscription or non-subscription based sales model.

Mistake 2 - Not accounting for current customer worth

Most CLV formulas available on the internet won’t consider the current status of your customers. To ensure you’re getting accurate results from your calculations, be sure to answer the following questions:

Is the customer recently active, or have they become inactive?

Do we have all the historical data of the customer, or did we just acquire them?

Is this a potential customer that we will acquire in the near future?

It’s important to analyze the current status of the customers before using different formulas to properly calculate CLV for current and future customers. You should also weigh this question while calculating CLV for churned customers.

Mistake 3 - Assuming retention rates remain constant

The final (and most common) mistake that ecommerce companies make is assuming customer retention rates will remain constant for a customer cohort over a period of time.

Realistically, each individual customer becomes loyal to a business over time. It’s important to acknowledge that customer behavior can vary from this moment, to the next. .

So before you calculate CLV for a cohort of customers, ensure that your rate of retention is accurately measured. Retention rate is a primary element for determining CLV.

Why is Adapting Customer Lifetime Value (CLV) Critical To Your Store?

Here are 5 reasons why you’ll want to examine CLV for your ecommerce business:

Empowers Trust and Brand Value

Have you ever put in a lot of effort to close just one sale? That doesn’t mean that your hard-fought customer is profitable for your business, simply because they made their first purchase. To have an impact on your bottom line, customers typically need to make several purchases.

And for customers to place multiple orders, they’ll need to trust your brand. However, trust is built over time. Customers rely on positive product experiences, quality support, and value obtained from your business.

Of course, you may already be investing heavily to improve your customer’s journey. You may have also focused on product development, marketing, customer success, and customer loyalty programs.

After infusing money into such priorities, you’ll want to know if your customers remain committed, and if they’ll continue to give you repeat business.

The best way to reveal these insights and assess your overall ROI is to analyze your customer lifetime value. It can also shed light on the outcomes of similar investments for the future.

By analyzing these details, you’ll know when your brand value has increased among your customers.

Enables Creative Thinking for Retention Strategies

Ever since the pandemic disrupted the world in 2020, many people have moved on to a new digital era. As a result, we’re now witnessing radical changes to advertising campaigns.

One such shift is the surge in campaign costs. Google and Facebook ad fees continue to increase, year after year. This is a huge pain point for ecommerce businesses, where customer acquisition can become like throwing good money after bad.

This is where CLV data is extremely useful.

CLV empowers your team to find creative ways to approach retention and customer success, using fact-based data. For example, an ecommerce store can analyze CLV to identify the most profitable customer age and web browser device (mobile, tablet, etc), where they can target their attention.

Helps Identify Profitable Customers

Speaking of customer demographics, one nutshell CLV helps you crack is your ideal customer profile.

When you determine which customer types offer the most value to your business, you can create strategies that boost targeted acquisition and retention.

This could include increasing your ad campaign budgets aimed at target customers, creating specialized customer loyalty programs, and more.

Marketing teams can also use ideal customer profiles to build t creative visuals that impress your most profitable customers.

In short, identifying your optimal customer gets you closer to a maximum return on investment.

Lends Insight into High Demand Products

After you learnt product X sold 10 times more than product Y, you can focus product development and ad campaigns in the right place.

Although the above example is a bit over the top, CLV will distinguish lucrative products by cross examining your profitable customers.

You can then refine your inventory, focused on merchandise that makes profitable customers happy.

Helps You Prepare for Investment Rounds

If you are looking to attract an investor, you’ll want to have your CLV calculated and ready, backed up by real numbers.

One of the first metrics investors care about is your CLV to CAC (Customer Acquisition Cost) ratio.

If this ratio is favorable, you’ll have better chances attracting the right investment fit for your business.

These are just some of the myriad benefits you’ll gain by understanding and adapting customer lifetime value. Most importantly, your ecommerce operation will have a customer-centric strategy.

Use Bloom to Improve Your Customer Lifetime Value

We can talk about CLV all day long, and suggest formulas & methods that can help you get the job done. In fact, we’ve written an extensive article around the same.

However, in the real world, you have finite time & resources and you need faster results to scale your ecommerce business.

To do so, you can either hire a team of analysts & data scientists (for a hefty price) or you can employ Bloom Analytics, which is specifically created for ecommerce store owners, to make the process easy, efficient, and cost effective.

Bloom’s intelligent architecture provides store owners with latest trends & actionable insights by grouping past & present customers into cohorts and analyzing their behavior. This cohort analysis also enables you to predict future behavior of your customers.

Among the many metrics it can track, Bloom ensures you’re up to date with CLV, CAC (customer acquisition costs), retention rate, churn rate, gross & net profit, and your most profitable customers.

Unlike the typical analytics process, which requires some level of hands-on experience, Bloom’s plug and play analytics takes the pain away and helps you concentrate on what matters the most, your business.

It integrates with Shopify, Google Analytics, Facebook, and other data sources to create meaningful insights about your ecommerce business, without breaking a sweat.

It is the ideal analytics platform for any Shopify and ecommerce business.

And yes, we do have a free trial, so you can experience all of this magic first hand.

So try Bloom today and accelerate your ecommerce store to the next level.

February 28, 2025

February 5, 2025

January 31, 2025

November 1, 2024

November 12, 2024